Diminishing depreciation formula

Diminishing depreciation rate formula Monday September 5 2022 Edit This accelerated depreciation method allocates the largest portion of the cost of an asset to the. Diminishing value method.

Declining Balance Depreciation Calculator

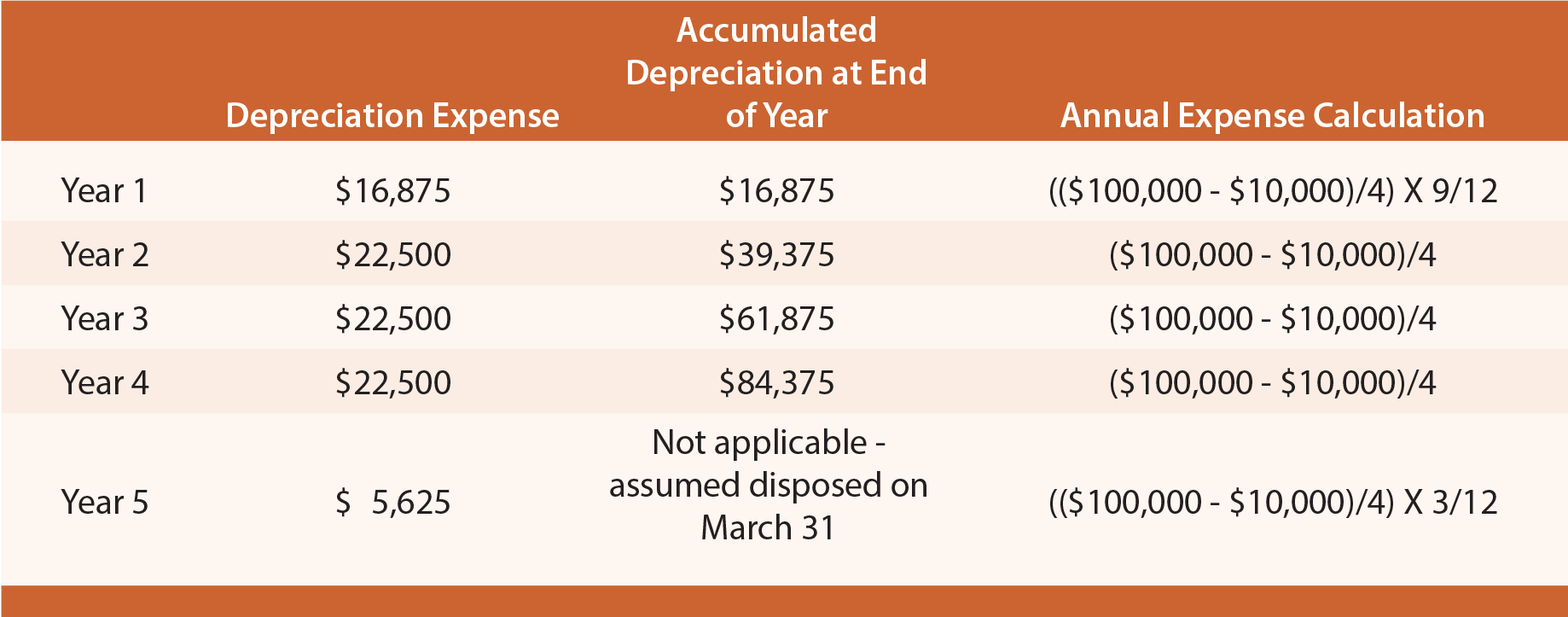

In straight-line depreciation the expense amount is the same every year over the useful life of the asset.

. The diminishing balance method of depreciation or as it is also known the reducing balance method calculates depreciation as a percentage of the diminishing value of. Closing balance opening balance depreciation amount. Diminishing Balance Method Example.

And the residual value is. Depreciation amount 1750000 12 210000. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. Depreciation amount opening balance depreciation rate. One such method of depreciation is.

Well here is the formula. Some of the merits of diminishing balance method are as follows. Another common method of depreciation is the diminishing value method.

The various methods of depreciation are based on a formula. 2000 - 500 x 30 percent 450. Straight-line depreciation is a very common and the simplest method of calculating depreciation expense.

Year 1 2000 x 20 400 Year 2 2000 400 1600 x. This formula is derived from the study of the behavior of the assets over a period of time. Depreciation amount book value rate of depreciation100.

80000 365 365 20 16000 Note that if you acquired the above asset part way through the year the final calculation using the prime cost method should occur. When using this method assets do not depreciate by an equal. It uses a fixed rate to calculate the depreciation values.

Base value days held see note. Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation youve. Recognised by income tax.

The DB function performs the following calculations. Use the diminishing balance depreciation method to calculate depreciation expenses. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

The rate of Depreciation 10 Year ending 31 March. The four main depreciation methods mentioned above are explained in detail below. Depreciation Rate of depreciation x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on.

A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Depreciation for a Period. Fixed rate 1 - salvage cost 1 life 1 - 100010000 110 1 -.

With the diminishing balance method depreciation is calculated as a percentage on the book. So Total Cost of an asset 110000015000050000 Rs 1300000- The following table shows the year by year. This formula is applicable to calculate the partial.

Depreciation Calculation

Reducing Balance Method Of Depreciation Youtube

Depreciation Formula Examples With Excel Template

Depreciation Of Building Definition Examples How To Calculate

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation All Concepts Explained Oyetechy

Accumulated Depreciation Definition Overview How It Works

Depreciation Worksheet And Leap Years Manager Forum

Depreciation Rate Formula Examples How To Calculate

Accumulated Depreciation Overview How It Works Example

Depreciation Formula Calculate Depreciation Expense

Youtube Method Class Explained